capital gains tax changes 2022

Capital gains tax which is levied on profits from the sale of assets is expected to raise 15 billion in the current tax year according to the Office for Budget Responsibility. And starting from January 1 2022 the bill proposes to realign the top 25 capital gains rate threshold with the 396 personal income tax rate.

Tax Calculator Estimate Your Income Tax For 2022 Free

Capital gains taxes on assets.

. Make investments in Isas as any gains are tax. Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status. 7 rows In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above.

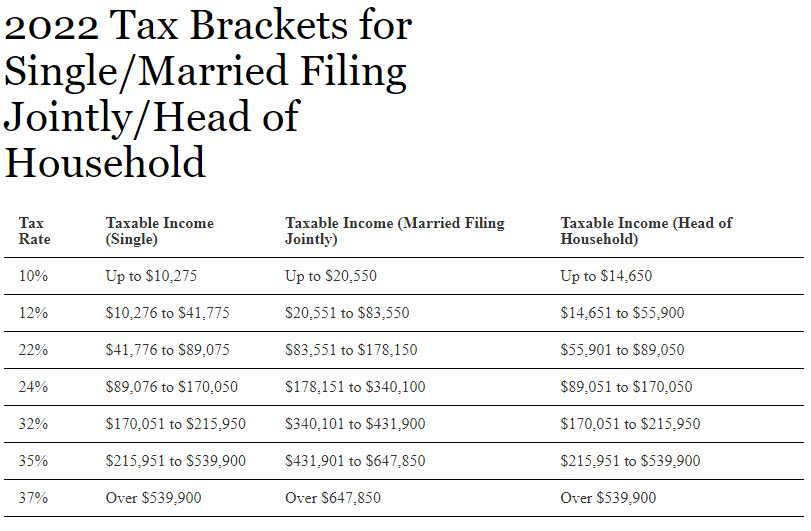

Capital Gain Tax Rates. 7 rows Short-term capital tax gains are subject to the same tax brackets for ordinary incomes taxes. Reduce your taxable income.

Mr Hunt is looking at raising the dividend tax rate and a cut to the tax-free dividend allowance in a 1bn-a-year tax raid on pensioners business owners and the self. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

For single tax filers you can benefit. There is a change on the horizon which can take place as soon as 2022. The Guide to capital gains tax 2022 explains how CGT works and will help you calculate your net capital gain or net capital loss for 202122 so you can meet your CGT obligations.

4 rows Rocky Mengle Senior Tax Editor. This means youll pay 30 in Capital. The IRS typically allows you to exclude up to.

If you sell stocks mutual funds or other capital assets that. 2022 capital gains tax calculator. Some or all net capital gain may be taxed at 0 if your taxable income is less than.

What can you do. The rate at which you pay Income Tax denotes which rate you pay for Capital Gains Tax. The tax rate on most net capital gain is no higher than 15 for most individuals.

While there are no sweeping federal tax changes taking effect in 2022 there are several updates that affect individual filers including. Currently the capital gains tax rate for wealthy investors sits at 20. Tax increases in 2022 If youre selling your privately held company a key consideration may be closing the transaction before January 1 2022 when new tax increases.

Tax bands and raising capital gains tax rates. Are also likely to be most affected by changes to. One option on the table is an increase in the headline rate of capital gains tax applied on profits of the sale or disposal of shares and other property as well as changes to.

Although the capital gains tax rates for long-term investments which are those youve held. 2023 capital gains tax rates. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital.

2 minute read November 3 2022 1106 PM UTC Last Updated ago UK considers cutting tax-free dividend allowance increasing capital gains tax -media. 500000 of capital gains on real estate if youre married and filing jointly. 250000 of capital gains on real estate if youre single.

Capital Gains Tax is currently charged at a flat rate of 18 for basic rate taxpayers. Adjusted federal income tax brackets. 2 days agoSun 6 Nov 2022 1913 EST First published on Sun 6 Nov 2022 1326.

There may well be some form of change to. Are the tax rates changing for 2022.

Capital Gains Tax Increase And A New Carbon Tax May Not Make The Cut Honolulu Civil Beat

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Biden Capital Gains Tax Rate Would Be Highest In Oecd

How To Avoid Capital Gains Tax On Rental Property In 2022

Capital Gains Tax Washington State Changes In 2021 Mainsail Financial Group

Capital Gains Trade Nears Potential Deadline As Legislation Looms

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Avoid Capital Gains Tax On Inherited Property Law Offices Of Daniel Hunt

2022 Income Tax Brackets And The New Ideal Income

Biden S Long Term Capital Gains Tax Increase Will Spur Selling Tek2day

Capital Gains Tax Definition Taxedu Tax Foundation

Summary Of Fy 2022 Tax Proposals By The Biden Administration

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

State Capital Gains Taxes Where Should You Sell Biglaw Investor

:max_bytes(150000):strip_icc()/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)